Costco Q4 2025 Earnings Results: Key Highlights and SWOT Analysis of Promises vs. Delivery

Costco’s Q4 and FY2025 results, released September 25, 2025, showcased resilient growth in sales, profits, and memberships. Quarterly net sales climbed to $84.4B (+8% YoY), driving full-year revenues to $269.9B and net income to $8.1B. Memberships hit a record 81M paid cards, with renewal rates holding above 92% in the U.S./Canada and nearly 90% worldwide—a clear signal of loyalty even as inflation pinches consumers.

E-commerce also delivered, with 13.6% Q4 growth, reflecting Costco’s push to expand digital reach while continuing to open new warehouses (914 globally at year-end).

These headline numbers only scratch the surface. To understand Costco’s position more fully, it helps to examine the financial drivers and risks behind them—how the company’s scale and membership model reinforce its strengths, where thin margins and competition expose vulnerabilities, and how last year’s strategic promises measure up against today’s results. Taken together, these dynamics shape the key takeaways from the financials and set the stage for a focused SWOT analysis of Costco’s performance heading into FY2026.

SWOT Analysis of Costco’s FY2025 Results

These headline numbers only scratch the surface. To understand Costco’s position more fully, it helps to examine the financial drivers and risks behind them—how the company’s scale and membership model reinforce its strengths, where thin margins and competition expose vulnerabilities, and how last year’s strategic promises measure up against today’s results. Taken together, these dynamics shape the key takeaways from the financials and set the stage for a focused SWOT analysis of Costco’s performance heading into FY2026.

Strengths

- Membership Engine Delivers – Membership income grew double digits, renewals remain above 92% in the U.S./Canada and close to 90% worldwide, showing management has sustained the “loyalty flywheel” it emphasizes [1].

- Resilient Revenue Growth – Full-year sales rose over 8%, stronger than the prior year’s pace, demonstrating Costco’s ability to hold volume and traffic despite inflationary headwinds [1].

- E-commerce Execution – Digital sales rose in the mid-teens with traffic up sharply, reflecting follow-through on the company’s commitment to improve the member digital experience [2].

- Kirkland Signature Strength – Costco’s private label continues to drive sales and brand stickiness, aligning with promises to expand its role as a value anchor across categories [2].

- International Expansion – Net new warehouses pushed the global total above 900, underscoring delivery on the stated goal of broadening geographic reach [1][2].

Weaknesses

- Thin Operating Margins – Gross margins remain around 11%, leaving Costco exposed to any cost shocks. The model works on scale, but profitability remains fragile [1].

- Dependence on Membership Fees – A significant share of bottom-line profit still comes from membership income. Any dip in renewal or slower growth could quickly pressure results [1].

- Limited Digital Breadth – While digital growth is strong, Costco’s online assortment lags larger e-commerce competitors, especially in general merchandise beyond groceries [2].

- High Labor & Logistics Costs – Wage increases and global supply chain expenses continue to weigh on cost structure, limiting operating leverage [2].

Opportunities

- Global Expansion – Continued warehouse growth in Europe and Asia, plus expansion into underserved U.S. markets, creates new runway [2].

- Digital and Mobile Ecosystem – Investments in app enhancements and logistics could expand e-commerce penetration beyond current levels [2].

- Private Label Innovation – Kirkland Signature has room to expand into wellness, apparel, and sustainability-focused products, supporting margin stability [2].

- Services & Partnerships – Travel, pharmacy, and financial services present avenues for deeper member engagement and fee-based income [2].

Threats

- Competitive Pressures – Walmart, Amazon, and regional grocers are intensifying on price and delivery speed, forcing Costco to balance scale with differentiation [2].

- Consumer Spending Risks – Higher interest rates and slowing wage growth could pressure discretionary categories, even if essentials remain strong [1].

- Regulatory & Labor Challenges – Rising scrutiny of wages, labor practices, and potential antitrust issues could create additional costs or operational limits [2].

- FX and Global Uncertainty – International expansion increases exposure to currency swings and geopolitical risks that could dampen earnings [2].

From Commitments to Results: What Costco Delivered in FY2025

| Promise | Fulfilled? |

|---|---|

| Kirkland Signature Growth | ✅ Yes |

| Digital Expansion | ✅ Yes (with gaps) |

| Competitive Wages | ⚠️ Partial |

| Warehouse Expansion | ❌ No |

Good company management is measured not only by the promises it makes but also by the consistency with which it fulfills them. Costco has historically emphasized transparency in its filings, outlining clear priorities around membership value, employee care, private-label expansion, and operational resilience. This section reviews the commitments made in last year’s Annual Report—alongside supporting signals from management commentary and external coverage—and evaluates how they translated into actual performance in the September 24, 2025 earnings release. While many promises have been fulfilled, reinforcing Costco’s reputation for disciplined execution, the next section turns to areas where ambitions have yet to fully materialize.

1. Expanding Kirkland Signature

Promise (Annual Report, Letters to Shareholders):

“We have exciting offerings planned for fiscal 2025, as we continue to invest in and expand the KS (Kirkland Signature) brand”

Performance:

By September 2025, Costco’s results highlighted continued KS growth, particularly in food categories and apparel, helping drive comparable sales growth and margin resilience [1].

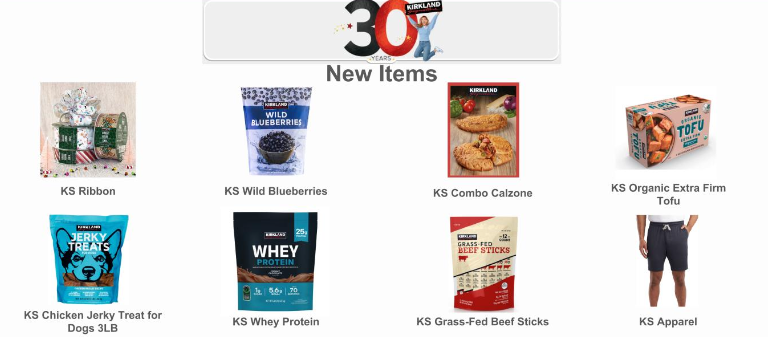

Costco highlighted several new Kirkland Signature products in its September 24, 2025 earnings release, including KS Whey Protein, KS Organic Extra Firm Tofu, KS Combo Calzone, and expanded apparel offerings. These launches reflect management’s ongoing commitment to keep Kirkland central to growth and differentiation.

Early signals from outside coverage show mostly positive momentum. Fortune noted that Costco marked Kirkland’s 30th anniversary with “more than 30 new products” entering the lineup, underscoring how critical the brand has become [3]. Food & Wine likewise pointed to a range of “member-approved” Kirkland items, especially in snacks and prepared foods [4].

On the earnings call, management reinforced Kirkland’s breadth, presenting it as a core driver of loyalty and margin stability [5]. Still, not all reactions have been glowing. Eating Well observed that while new items are gaining traction, changes to familiar recipes and the discontinuation of certain favorites have stirred mixed reviews among members [6].

2. Digital Expansion

Promise (Annual Report, Letters to Shareholders):

“We continue to make significant improvements to the Costco App—increasing response speed and reliability and adding key features such as the ability to search U.S. warehouse inventory, access online receipts, and maintain a digital membership card and wallet.

Performance:

Costco’s 8-K filing highlighted that digital sales continued to post double-digit growth in FY2025, with e-commerce comparable sales rising 13.6% in Q4 and 15.6% for the year [1]. This momentum reinforces the Annual Report’s promise to improve the Costco App with faster response speed, better reliability, and features like warehouse inventory search, online receipts, and a digital membership wallet [2].

Official materials confirm these upgrades. Costco’s app page now lists tools such as “search warehouse inventory” and access to digital receipts and membership cards [7] User reviews in 2025 highlight ongoing frustrations: frequent lag, inconsistent product search, and missing features like downloadable receipts. Many compare the app unfavorably to competitors, calling it “decades behind" [8]. Media outlets also noted that the inventory search feature was being rolled out to members, making in-store shopping more predictable [9]. Meanwhile, RetailWire reported that Costco is piloting Scan & Pay in 27 warehouses, signaling another step toward a more modern digital shopping experience [9].

Still, customer sentiment remains mixed. While members appreciate the convenience of the digital card and improved features, frustration lingers. The New York Post captured criticism from users calling the app “dated” and complaining of persistent issues like slow loading, frequent logouts, and difficulty managing purchase history [10].

In short, Costco has delivered on its promise to strengthen the app, and the numbers show those improvements are driving measurable digital growth. Yet execution gaps remain, and member feedback suggests there is still work to be done to meet expectations for speed and usability.

3. Employee Wages & Labor Practices

Promise (Annual Report, p. 7):

“Costco strives to provide our employees with competitive wages and excellent benefits… We remain committed to protecting the health and safety of our members and employees and to serving our communities.”

Performance:

Costco did raise wages in FY2024 and highlighted its competitive benefits in both investor communications and public statements [2]. However, FY2025 also brought challenges. The company faced labor-related lawsuits, including a wage theft complaint filed by Teamsters Local 174 alleging Costco refused to pay contractually agreed increases to fleet drivers [11]. A proposed class action in the Ninth Circuit also challenges Costco’s paycheck practices and potential overtime misclassification [12]. In addition, another class action alleges that junior managers were required to work over 40 hours per week without overtime, claiming misclassification as exempt employees [13].

These developments complicate the narrative, suggesting that while Costco’s compensation structure is relatively strong in retail, it has not consistently delivered on its promise of fair and competitive pay across all regions and legal contexts.

4. Growth & Expansion

Promise (Annual Report, p. 15, 28–29):

“Our international operations have accounted for an increasing portion of our warehouses, and we plan to continue international growth …” [2, p. 15]. In addition, management stated: “We opened 30 new warehouses, including one relocation, in 2024, and plan to open up to 29 additional new warehouses, including three relocations, in 2025.” [2, pp. 28–29]

Performance:

| Region | Q4 FY’24 End | FY’25 Q1–Q3 | FY’25 Q4 | FY’25 End | FY’26 (E) |

|---|---|---|---|---|---|

| US | 614 | 10 | 5 | 629 | 649 |

| Canada | 108 | 1 | 1 | 110 | 115 |

| Other International | 168 | 4 | 3 | 175 | 180 |

| Total | 890 | 15 | 9 | 914 | 944 |

Source: [2]

In FY2025, Costco did not fully deliver on its expansion commitments. Management had projected up to 29 new warehouses, including three relocations, but the company ultimately opened 24, falling short by five [1]. More importantly, the growth remained disproportionately weighted toward the U.S., which accounted for 15 of the new locations. International markets, emphasized as a strategic priority in the Annual Report [2], saw only seven openings—well below the balance implied by management’s promise to accelerate global growth. This outcome indicates that while Costco maintained its domestic momentum, it failed to match expectations for international expansion, leaving its footprint more U.S.-centric than intended.

Sources

[1] Costco Wholesale Corporation, Form 8-K, September 24, 2025 – Earnings Release.

[2] Costco Wholesale Corporation, Form 10-K, Annual Report for Fiscal Year Ended September 1, 2024 (including Management’s Discussion & Analysis).

[3] Fortune. “Costco sees more growth for its $31.9 billion real-estate …” September 26, 2025. Available at: https://fortune.com/2025/09/26/costco-earnings-real-estate-warehouses-hot-dogs-40th-birthday-kirkland/. Last accessed: September 28, 2025.

[4] Food & Wine. “7 Member-Approved Fall Finds at Costco.” 2025. Available at: https://www.foodandwine.com/costco-fall-products-2025-11813607. Last accessed: September 28, 2025.

[5] Fortune. “Costco Q4 2025 Earnings Call Transcript.” 2025. Available at: https://fortune.com/company/costco/earnings/q4-2025/. Last accessed: September 28, 2025.

[6] Eating Well. “4 Kirkland Products I Never Thought I’d Buy at Costco.” 2025. Available at: https://www.eatingwell.com/kirkland-products-i-always-buy-at-costco-8783444. Last accessed: September 28, 2025.

[7] GoodHousekeeping. “Costco is beta-testing a warehouse inventory search feature in its mobile app.” 2025. Available at: https://www.goodhousekeeping.com/life/money/a61425411/costco-app-warehouse-inventory-search/. Last accessed: September 28, 2025.

[8] Google Play Store (Android). “Costco App – User Reviews (2025 snapshot).” 2025. Available at: https://play.google.com/store/apps/details?id=com.costco.app.android&hl=en&gl=US. Last accessed: September 28, 2025.

[9] RetailWire. “Costco testing Scan & Pay in 27 warehouses.” 2025. Available at: https://retailwire.com/discussion/costco-testing-scan-pay-in-27-warehouses/. Last accessed: September 28, 2025.

[10] New York Post. “Costco shoppers rip store’s mobile app as dated and frustrating.” 2025. Available at: https://nypost.com/2025/03/14/costco-shoppers-rip-mobile-app/. Last accessed: September 28, 2025.

[11] Teamsters Local 174. “Teamsters File Wage Theft Complaint Against Costco.” 2025. Available at: https://teamster.org/2025/06/teamsters-file-wage-theft-complaint-against-costco/ Last accessed: September 28, 2025.

[12] Law360. “Costco Dodging OT Payments, Junior Managers Say.” 2023. Available at: https://www.law360.com/employment-authority/articles/1736112/costco-dodging-ot-payments-junior-managers-say Last accessed: September 28, 2025.

[13] Justia. “Lock et al v. Costco Wholesale Corporation (Junior Manager Overtime Misclassification).” 2025. Available at: https://law.justia.com/cases/federal/district-courts/new-york/nyedce/2%3A2023cv07904/504854/40/ Last accessed: September 28, 2025.