Carnival Q3 2025 Results: Earnings Results: Key Highlights and SWOT Analysis of Promises vs. Delivery

Carnival delivered the strongest quarter in its history, driven by robust demand, record yields, disciplined cost management, and balance sheet improvements. With upgraded full-year guidance and strong forward bookings for 2026 and 2027, the company is well-positioned to further expand profitability, strengthen its financial profile, and capture market share in leisure travel.

SWOT Analysis of Carnival's Q3 2025 Results

To understand Carnival’s position more fully, it helps to examine the financial drivers and risks behind them—how record profitability, brand reach, and exclusive destinations reinforce strengths, where high leverage and cost sensitivity expose vulnerabilities, and how strategic initiatives such as Celebration Key, European dominance, and Alaska assets measure up against today’s results. .

Strengths

| Promise | Fulfilled? |

|---|---|

| Investment Grade Balance Sheet | ⚠️ Partial |

| Exclusive Destination Development | ✅ Yes (Phase 1) |

| Operational Efficiency & Sustainability | ⚠️ Mixed |

| Reducing Dependence on Close-In Demand | ⚠️ Partial |

- Record Financial Delivery – Net income of $1.9B, adjusted net income of $2.0B, and adjusted EBITDA of $3.0B all reached new highs, outpacing guidance on every measure [1][2].

- Strong Booking Momentum – 2026 is nearly half booked at historical high prices, with 2027 off to a record start in volumes, providing long-term visibility [1][2].

- Exclusive Destinations Advantage – Celebration Key launched to rave reviews with ~1.5B media impressions; together with six other Caribbean properties, Carnival expects to host over 8M guest visits in 2026—comparable to all peers combined [2].

- Regional Market Leadership – #1 or #2 market share across major European markets, plus unmatched Alaska footprint with hotels, rail cars, and motorcoaches, creating yield premiums and unique land-sea experiences [2].

- Operational Efficiency – Net yields up 4.6% YoY, fuel consumption per ALBD down 5.2%, adjusted ROIC reached 13% for the first time in nearly 20 years [1][2].

Weaknesses

- Leverage Still Elevated – Despite over $11B refinanced YTD, Carnival’s total debt remains $26.5B, with net debt to EBITDA at 3.6x, above investment-grade thresholds [1].

- Cost Pressures – Adjusted cruise costs per ALBD (Available Lower Berth Day, the industry’s standard measure of daily capacity per passenger bed) rose 5.5% year-over-year—though better than guidance. This increase signals that while Carnival is controlling costs more effectively than expected, rising labor, logistics, and supply chain expenses are still pushing up the average daily cost of operating each available berth, leaving margins sensitive to inflation [1][2].

- Exposure to Close-In Demand – A notable driver of Q3 outperformance was close-in bookings—reservations made within a relatively short window before the sailing date (often weeks rather than months in advance). While these last-minute sales can boost yields when demand is strong, they also make Carnival more vulnerable if consumer sentiment softens. In a weaker spending environment, close-in demand tends to fall first, which could quickly reduce pricing power and occupancy. This reliance adds short-term upside in strong markets but increases downside risk when discretionary travel budgets tighten [1].

- Capital-Intensive Model – Newbuilds, destination investments, and fleet modernization require sustained high capex, constraining flexibility during downturns [2].

- Profitability Sensitivity – Margins remain vulnerable to swings in fuel prices, interest costs, and FX, despite hedging and efficiency gains [1][2].

Opportunities

- Upside from Pricing Power – Carnival continues to see potential to narrow the price-to-value gap with land-based vacations, supporting long-term yield growth [1].

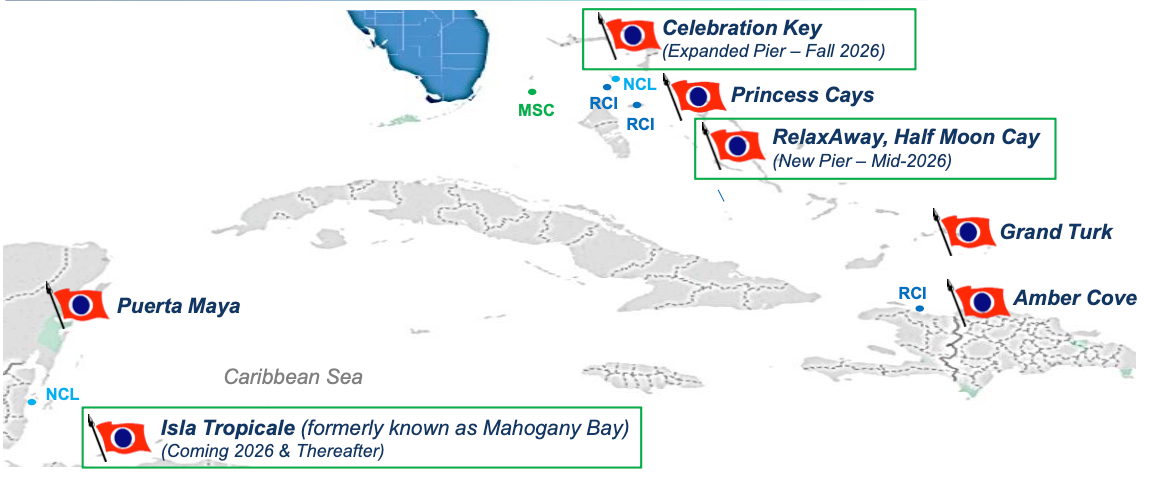

- Exclusive Destinations Expansion – Upcoming enhancements at Half Moon Cay and Isla Tropicale (formerly Mahogany Bay) will extend the destination advantage [2].

- Fleet Modernization – Deliveries like Star Princess and the ongoing AIDA Evolution program strengthen premium offerings and broaden brand appeal [1][2].

- Deleveraging Path – Ongoing refinancing and the redemption of convertible notes are expected to reduce net debt/EBITDA toward ~3.5x in early 2026, with a longer-term goal below 3.0x [2].

- Sustainability Leadership – Energy efficiency gains (fuel per ALBD down 5.2%) and progress on 2026 ESG targets 18 months early reinforce Carnival’s environmental positioning [1][2].

Threats

- Macroeconomic Uncertainty – High interest rates, inflation, or weakening consumer spending could reduce demand for discretionary travel [1][2].

- Fuel Price Volatility – A 10% swing in fuel prices impacts adjusted net income by ~$42M per quarter, underscoring margin risk [1].

- Competitive Intensity – Rivals like Royal Caribbean, Norwegian, and land-based resorts continue to press on pricing, branding, and exclusive destinations [2].

- Geopolitical & Regulatory Risks – Operations are exposed to changing regulations, sanctions, and geopolitical instability across markets [1].

- Reputation & Safety Risks – Incidents affecting ships or guest experience could quickly undermine brand trust and future demand [1][2].

From Commitments to Results: What Carnival Delivered so Far in FY2025

| Promise | Fulfilled? |

|---|---|

| Investment Grade Balance Sheet | ⚠️ Partial |

| Exclusive Destination Development | ✅ Yes (Phase 1) |

| Operational Efficiency & Sustainability | ⚠️ Mixed |

| Reducing Dependence on Close-In Demand | ⚠️ Partial |

Good company management is measured not only by the promises it makes but also by the consistency with which it fulfills them. Carnival has sought to rebuild investor confidence by emphasizing transparency in its filings and investor presentations, setting priorities around balance sheet recovery, exclusive destination development, operational efficiency, and sustainability. This section reviews the commitments made in the 2024 Form 10-K—supplemented by management commentary and external coverage—and evaluates how they translated into actual performance in the September 29, 2025 earnings release. While several promises have been fulfilled, particularly in destination launches and efficiency gains, other ambitions remain only partially delivered, leaving the next phase of Carnival’s turnaround dependent on continued execution.

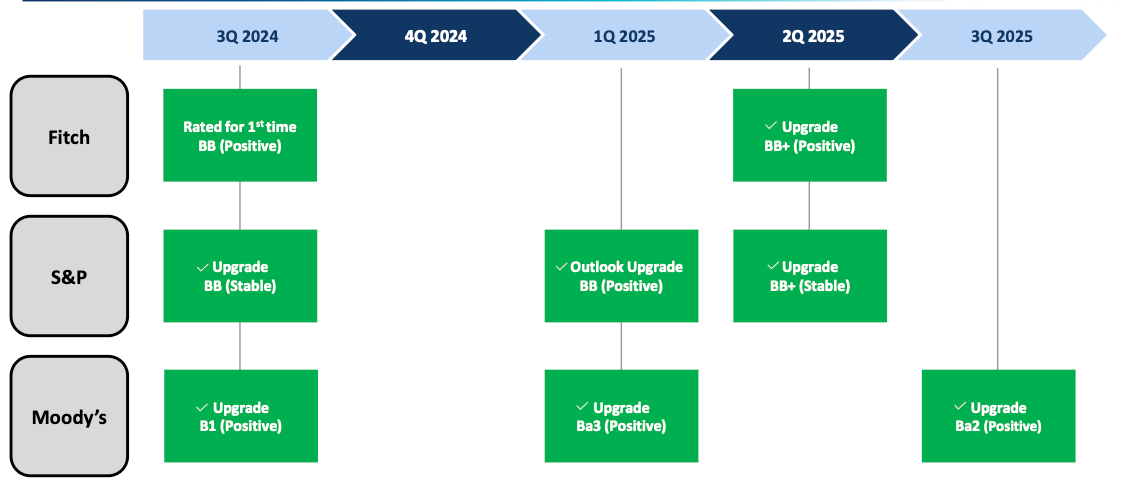

1. Investment Grade Balance Sheet

Promise ([3] 10K Annual Report, p 6):

"We believe this will allow us to responsibly reduce our debt over time, improve our return on invested capital as well as return to investment-grade leverage metrics.”

Performance:

Carnival delivered meaningful progress in FY2025. According to the Q3 8-K, the company refinanced over $11 billion of debt and prepaid an additional $1 billion year-to-date, while reducing secured debt by nearly $2.5 billion [1][2]. Net debt-to-EBITDA improved to 3.6x, down from 4.7x in FY2024, and management expects to reach ~3.5x by early 2026. Credit agencies acknowledged this progress: Moody’s upgraded Carnival’s rating and maintained a positive outlook[4], S&P revised its outlook to positive while affirming ratings [5], and Fitch upgraded Carnival to investment grade (BBB–) with a stable outlook [6]. Together, these actions underscore delivery on the deleveraging promise and position Carnival for lower financing costs and greater balance sheet flexibility [2][3].

2. Exclusive Destination Development

Promise ([3] 10k Annual Report, p.13):

“We operate a portfolio of port destinations and exclusive islands enabling us to offer exceptional experiences to 6.5 million guests by creating a wide variety of high-quality destinations that are uniquely tailored to our guests’ preferences. In addition, to secure preferential berth access to third-party ports, we enter into berthing agreements and commitments.”

Performance:

| Promise | Fulfilled? |

|---|---|

| Puerta Maya (Cozumel, Mexico) | ✅ Yes |

| Grand Turk Cruise Center (Turks & Caicos) | ✅ Yes |

| Mahogany Bay (Isla Roatán, Honduras) | ⚠️ Partial |

| Amber Cove (Dominican Republic) | ✅ Yes |

| RelaxAway, Half Moon Cay (Bahamas) | ⚠️ Partial |

| Princess Cays (Bahamas) | ✅ Yes |

| Celebration Key (Grand Bahama Island) | ✅ Yes (Phase 1) |

Source:[3, p13]

In Q3 2025, Carnival officially launched Celebration Key in the Bahamas, on time and on budget, drawing heavy media attention including nearly 1.5 billion media impressions at its opening [2]. Nearly half a million guests have already visited, with 3 million expected in 2026. Alongside upgrades at Half Moon Cay (rebranded as RelaxAway) and the rebranded Isla Tropicale (formerly Mahogany Bay), Carnival now projects over 8 million guest visits across its seven private Caribbean properties in 2026—nearly matching the combined traffic of all peer private-destination offerings [2].

Guest reviews are generally positive, though critiques highlight areas for refinement. Eat Sleep Cruise praised the expansive lagoons and design but noted drawbacks such as limited included dining options and adults-only enforcement [7]. Cruise Blog called the destination “undeniably cool,” while flagging extra costs for food and drinks as a negative [8]. For Half Moon Cay, Cruise Critic user reviews average 4.3/5 stars across 1,180 reviews, with guests calling it their “absolute favorite port” for its pristine beach setting [9].

3. Operational Efficiency & Sustainability

Promise ([3] 10k Annual Report, p.24):

"We have a four-part strategy to reach our climate goals: (1) fleet optimization through larger, more efficient ships; (2) energy efficiency upgrades like power saver packs, air lubrication, and shore power; (3) itinerary efficiency via smarter route design and port investments; and (4) advancing new technologies and alternative fuels, including battery storage, carbon capture, and bio/synthetic fuels.”

Performance:

| Promise | Fulfilled? |

|---|---|

| Fleet Optimization | ✅ Yes |

| Energy Efficiency | ✅ Yes |

| Itinerary Efficiency | ⚠️ Partial |

| New Technologies & Alternative Fuels | ⚠️ Partial |

Fleet Optimization – Carnival advanced its fleet modernization in FY2025 with the delivery of the Star Princess, sister ship to Sun Princess, a dual-fuel LNG-powered vessel built by Fincantieri with modern efficiency systems [10]. In parallel, the company advanced the AIDA Evolution program, beginning with the extensive refit of AIDAdiva, which introduced energy-efficient systems, upgraded staterooms, and new guest amenities. Additional ships, including AIDAluna and AIDAbella, are scheduled for similar upgrades through 2026 [11][12]. These initiatives support Carnival’s strategy to retire or retrofit less efficient vessels while enhancing sustainability across the fleet.

Energy Efficiency – Delivered. Fuel consumption per ALBD declined 5.2% YoY, supported by efficiency projects such as air lubrication systems, service power packages, and expanded shore power adoption [2]. These measures contributed to Carnival achieving its 2026 SEA Change fuel efficiency target 18 months early [2].

Itinerary Efficiency – Carnival highlighted new itineraries featuring Celebration Key and RelaxAway, which it says reduce sailing distances and fuel use [2]. Independent research supports the principle: studies show that optimized routes and slower speeds can materially cut cruise emissions [13][14]. However, Carnival’s specific emission savings from these new itineraries have not been independently verified, and evidence so far comes only from the company’s own disclosures. Itinerary design remains widely recognized by industry, academia, and regulators as a credible lever for emission reduction, but third-party confirmation of Carnival’s results is still pending.

New Technologies & Alternative Fuels – Carnival has begun investing in advanced technologies, but progress is still at the pilot stage. A 10 MWh lithium-ion battery was installed on AIDAperla, the largest on a passenger ship to date, though no fleet-wide rollout is planned [15]. AIDA Cruises trialed bio-methanol and bio-methane blends with up to 85% emission reductions [16], while Holland America Line completed a 20-day biofuel trial on Volendam [17]. Other ships, including Carnival Magic and Rotterdam, have also tested biofuels [15]. Carbon capture and synthetic fuels remain under research, with Carnival participating in hydrogen-derived methanol fuel cell projects via Pa-X-ell2 [18].

4. Reducing Dependence on Close-In Demand

Promise ([15] Earnings Presentation, p15):

“Strengthen the booking curve by securing advance sales at higher prices, optimizing the booking cycle.”

Performance (Not Fully Delivered):

Carnival secured record advance bookings for 2026 and 2027, demonstrating progress on building a longer booking curve. However, Q3 2025 outperformance leaned heavily on close-in demand (last-minute bookings) [1]. While this boosted yields in the near term, it runs counter to the stated objective of smoothing demand further in advance, leaving the company vulnerable if consumer sentiment weakens.

Sources

[1] Carnival Corporation & plc – 2025 Q3 Earnings Release (8-K)

[2] Carnival Corporation & plc – Q3 2025 Earnings Presentation

[3] Carnival Corporation & plc – 10k 2024

[4] “Carnival Corporation’s ratings upgraded by Moody’s, positive outlook forecasted.” Investing.com, February 14, 2025. Available at: https://www.investing.com/news/stock-market-news/carnival-corporations-ratings-upgraded-by-moodys-positive-outlook-forecasted-93CH-3871341. Last accessed: October 4, 2025.

[5] S&P Global Ratings. “Carnival Corp. Outlook Revised To Positive, Ratings Affirmed.” September 2025. Available at: https://www.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/3450222. Last accessed: October 4, 2025.

[6] Fitch Ratings. “Fitch Upgrades Carnival Corporation IDR to ‘BBB–’; Outlook Stable.” October 1, 2025. Available at: https://www.fitchratings.com/research/corporate-finance/fitch-upgrades-carnival-corporation-idr-to-bbb-outlook-stable-01-10-2025. Last accessed: October 4, 2025.

[7] Eat Sleep Cruise. “Carnival Celebration Key Review.” July 2025. Available at: https://eatsleepcruise.com/celebration-key-review. Last accessed: October 4, 2025.

[8] Cruise Blog. “4 Things I Loved and 3 I Hated About Carnival’s Celebration Key.” July 2025. Available at: https://cruise.blog/2025/07/4-things-i-loved-and-3-i-hated-carnival-celebration-key . Last accessed: October 4, 2025.

[9] Cruise Critic. “Half Moon Cay Cruise Reviews.” 2025. Available at: https://www.cruisecritic.com/memberreviews/ports/half-moon-cay-cruises. Last accessed: October 4, 2025.

[10] Offshore Energy. “Princess Cruises Receives Second Dual-Fuel LNG Powered Unit from Fincantieri.” 2025. Available at: https://www.offshore-energy.biz/princess-cruises-receives-second-dual-fuel-lng-powered-unit-from-fincantieri/. Last accessed: October 4, 2025.

[11] Cruise Industry News. “AIDA Evolution Program Paying Off for Carnival.” June 2025. Available at: https://cruiseindustrynews.com/cruise-news/2025/06/aida-evolution-program-paying-off-for-carnival/. Last accessed: October 4, 2025.

[12] Seatrade Cruise News. “Upgraded Staterooms and New Restaurants Onboard AIDAdiva.” May 2025. Available at: https://www.seatrade-cruise.com/refurb-design-interiors/upgraded-staterooms-and-new-restaurants-onboard-aidadiva. Last accessed: October 4, 2025.

[13] SailPlan. “Optimizing Cruise Ship Itineraries Through Advanced Fuel Emissions Monitoring.” 2023. Available at: https://www.sailplan.com/optimizing-cruise-ship-itineraries-through-advanced-fuel-emissions-monitoring/. Last accessed: October 4, 2025.

[14] MDPI. “Mathematics of Cruise Ship Route Optimization for Environmental and Operational Efficiency.” 2024. Available at: https://www.mdpi.com/2227-7390/12/12/1847. Last accessed: October 4, 2025.

[15] Carnival Corporation & plc – Q4 2024 Earnings Presentation