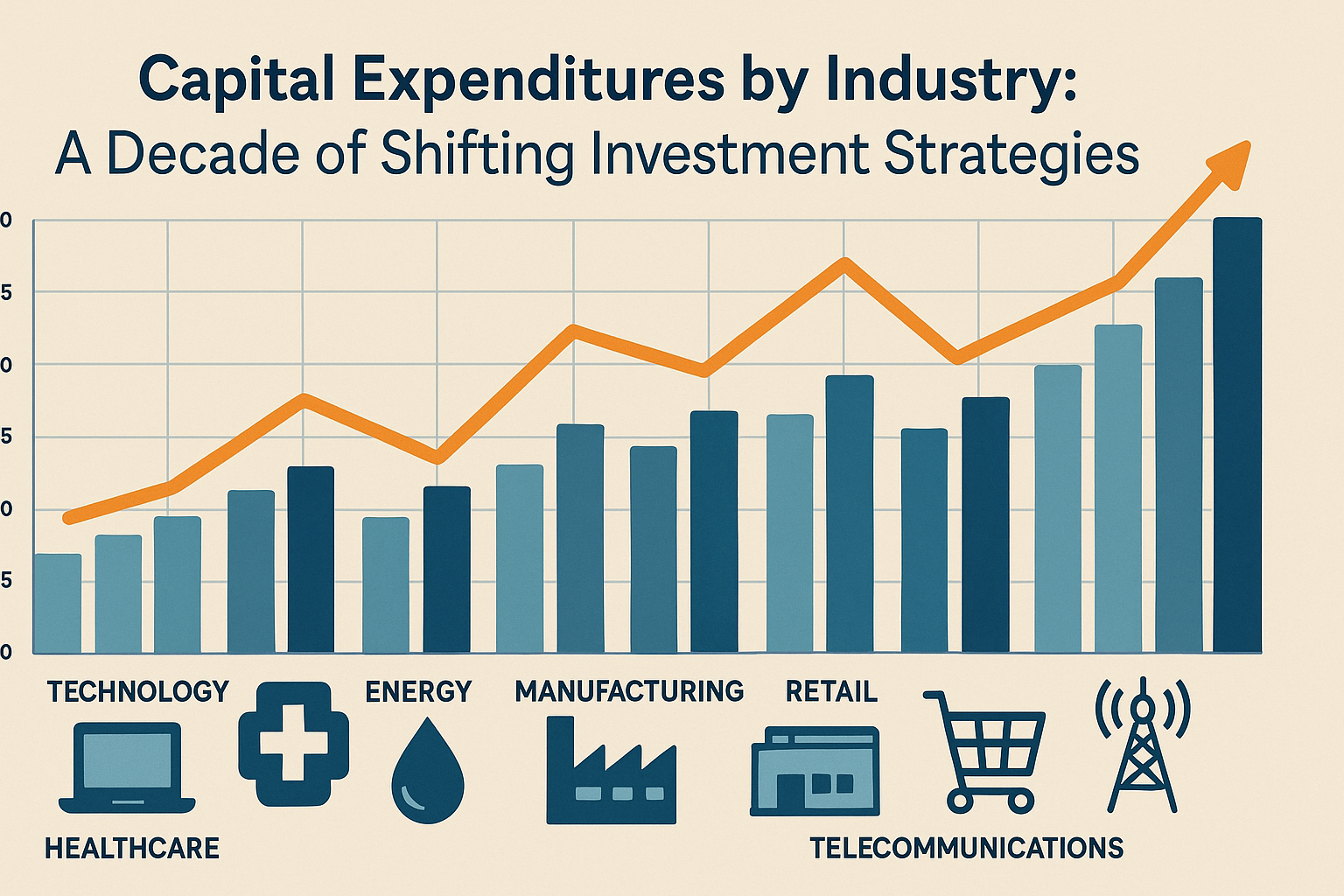

Inflation Adjusted Capital Expenditures US companies

Over the past decade, capital expenditures (CapEx) across major U.S. industries have revealed critical shifts in corporate strategy, economic resilience, and policy-driven priorities. By examining CapEx relative to operating cash flows (investment rate), we gain insight into how different sectors deploy their financial resources. This blog explores major CapEx patterns from 2010 to 2023 and connects them with macroeconomic events and political developments.

Energy & Transportation: The Boom, Bust, and Rebound

- From 2010 through 2014, the Energy & Transportation sector consistently led all industries in real capital investment, peaking in 2014 with a CapEx of nearly $300 billion (in constant 2010 dollars).

- This surge was fueled by the shale boom, record oil prices, and strong global demand for energy infrastructure.

- Following the 2014 oil price crash, driven by oversupply and strategic moves by OPEC, investment declined sharply.

- By 2016, inflation-adjusted investment had dropped by more than 25%, although the sector continued to prioritize infrastructure relative to cash flows.

- Despite the pandemic-driven demand collapse in 2020, investment remained resilient.

- Many companies completed committed projects, resulting in a temporary spike in the investment rate even as revenues fell.

- In 2022 and 2023, Energy & Transportation CapEx recovered strongly, reaching around $230 billion (in constant 2010 dollars).

- This resurgence reflected renewed energy security concerns, elevated oil prices, and policy support.

Technology: Post-COVID Acceleration and the AI Race

- The technology sector has shown strong real CapEx growth since 2010, with modest early gains accelerating sharply after 2015.

- By 2020, technology CapEx reached about $180 billion in 2010 dollars, boosted by pandemic-driven digital demand.

- Subsequent years saw continued growth as cloud infrastructure, remote work capabilities, and semiconductor investments expanded.

- In 2023, the rapid adoption of generative AI triggered another wave of investment, with real CapEx approaching $224 billion.

- Leaders like Microsoft, Google, Amazon, and Meta drove heavy investment into data center and compute infrastructure.

Manufacturing: Reshoring and Industrial Policy Take Hold

- Manufacturing sector investment was relatively stable through much of the 2010s, ranging between $70 billion and $90 billion (real).

- Starting in 2021, U.S. industrial policy — including the CHIPS and Science Act (2022) and Inflation Reduction Act (2022) — helped trigger a surge.

- By 2023, manufacturing CapEx had risen to nearly $127 billion (in 2010 dollars).

- Semiconductor fabrication, clean manufacturing technologies, and domestic supply chain initiatives were major contributors to this investment boom.

Life Sciences: Strategic but Conservative Growth

- Life Sciences demonstrated a cautious but steady expansion of capital spending.

- Real CapEx increased from $10 billion in 2010 to about $25 billion by 2023.

- Temporary boosts during COVID-19 led to expansions in biomanufacturing capacity.

- However, the sector remained relatively capital-light, with R&D remaining the primary focus rather than physical asset expansion.

Finance and Real Estate: Rate Sensitivity Dominates

- CapEx for Finance and Real Estate sectors followed broader macroeconomic trends.

- From 2010 to 2019, inflation-adjusted investments remained modest, rarely exceeding $70 billion combined.

- In the low-rate environment post-COVID, there were slight real CapEx increases.

- However, starting in 2022, aggressive interest rate hikes curbed new investments sharply.

- Real Estate investment, in particular, flattened in 2023 as financing costs surged.

Trade & Services: Steady, Resilient Expansion

- The Trade & Services sector saw consistent inflation-adjusted CapEx growth, rising from $70 billion in 2010 to over $112 billion by 2023.

- COVID-19 caused a temporary dip, but investments rebounded quickly as consumer demand and logistics activities resumed.

Conclusion

Capital expenditures, when adjusted for inflation to a constant 2010 dollar base, reveal true strategic shifts across industries.

From the energy transition and digital acceleration to industrial reshoring and AI-driven infrastructure booms, CapEx data highlights where companies are placing their long-term bets.

As the global economy continues to navigate geopolitical risks, technological revolutions, and climate imperatives, monitoring real investment patterns will remain critical for understanding the real economy beneath the headlines.